Is JFIN's High Dividend Yield a Trap?

Jiayin Group (JFIN), a Chinese fintech company, currently boasts a compelling dividend yield, hovering around 8.81% (as of February 12, 2025, based on data from MarketBeat). This significantly outpaces many other companies, making it tempting for income-seeking investors. However, this high yield warrants a thorough examination before any investment decision. Is this a genuine opportunity or a potential pitfall disguised in attractive numbers? Let's delve into the details.

Understanding JFIN's Dividend History and Current Payout

JFIN has maintained a consistent semi-annual dividend payment, totaling approximately $0.88 per share annually. This regularity suggests a commitment to shareholder returns. But, a high dividend yield alone isn't enough to gauge investment viability. We need to analyze the broader financial picture and consider the sustainability of this payment. A high yield can sometimes mask underlying financial weaknesses.

JFIN's Growth Trajectory and Profit Allocation

While the high dividend is attractive, JFIN's historical growth figures present a less optimistic outlook. The company has not demonstrated consistently strong growth. This raises concerns about the long-term sustainability of the dividend. Approximately 28% of JFIN's earnings are currently allocated to dividends. This substantial payout ratio (the percentage of earnings paid out as dividends) leaves less for reinvestment in the company's growth and future development – a crucial element for long-term stability. This raises the question: is this level of dividend payout sustainable in the long run?

Is JFIN prioritizing short-term shareholder returns at the expense of long-term growth potential?

Navigating the Volatility of the Fintech Sector

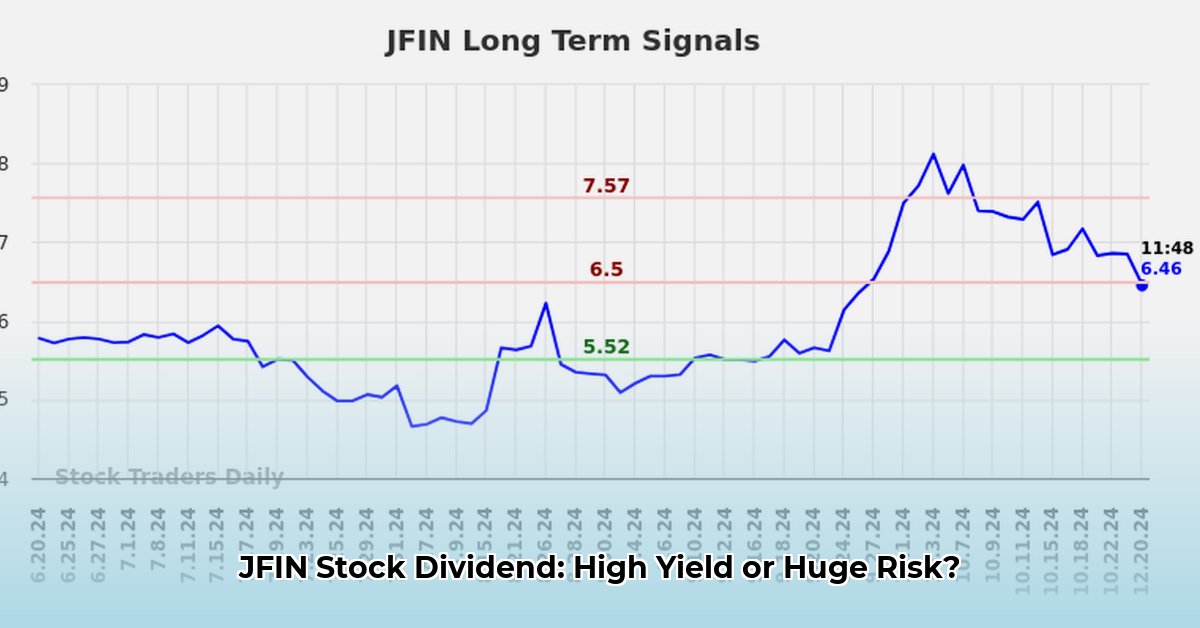

JFIN operates within the volatile fintech sector, known for its dramatic market swings. This inherent volatility presents a significant risk to its dividend. Even if JFIN maintains financial health, external market factors could negatively impact its ability to sustain these high dividend payments. This unpredictability underlines the need for caution.

What strategies can investors use to mitigate the risk of this market volatility?

Investment Strategies: Short-Term vs. Long-Term

The optimal strategy for investing in JFIN's dividend depends heavily on individual investment objectives and time horizons.

Short-Term Investors (Less than 1 Year): The high yield is attractive for short-term income generation. However, the inherent volatility of the fintech sector requires careful risk management. Diversification across multiple assets is crucial.

Long-Term Investors (3-5 Years or More): Long-term investors should carefully weigh JFIN's limited historical growth against the high dividend payout. The high payout ratio is a significant factor, reflecting less capital available for growth initiatives. More conservative investments with higher growth potential may be more suitable.

What is the optimal balance between high yield and sustainable growth for long-term investment success?

Assessing Risk: A Detailed Breakdown

The potential risks associated with JFIN’s dividend, and their likelihood, include:

| Risk Factor | Likelihood | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Dividend Cuts | Moderate | Severe | Diversify, monitor financial health, and analyze growth prospects. |

| Market Volatility | High | Severe | Diversify, consider stop-loss orders, understand your risk tolerance. |

| Competition | Moderate | Moderate | Track competitors, understand industry trends. |

| Regulatory Changes | Moderate | Moderate | Stay informed regarding potential regulatory shifts impacting JFIN. |

| Earnings Decline | Moderate | Severe | Thorough financial statement analysis to identify warning signs. |

The Bottom Line: A Balanced Perspective

JFIN's dividend is undeniably tempting, particularly for income-focused investors. However, this high yield is directly linked to significant risk. The company's limited growth and the substantial dividend payout raise concerns about long-term sustainability. Investors must meticulously evaluate their own risk tolerance, ensure portfolio diversification, and commit to continuous monitoring of JFIN's financial performance and market developments. This is not a passive investment; active management and ongoing due diligence are paramount to success. Remember to consult a financial advisor for personalized guidance.

Mitigating Dividend Cut Risk: A Step-by-Step Guide

To mitigate the risk of a dividend cut, investors should adopt a multi-faceted approach:

Diversify your portfolio: Reduce reliance on JFIN by investing in a variety of asset classes and companies. This reduces the impact of a potential dividend cut.

Conduct thorough due diligence: Carefully analyze JFIN's financial statements, paying attention to key metrics like the payout ratio, debt levels, cash flow, and earnings growth.

Monitor key metrics regularly: Track JFIN's financial health using the metrics mentioned above to identify potential problems early.

Consider macroeconomic factors: China's economic environment and regulatory changes heavily influence JFIN. Stay informed on relevant news and economic forecasts.

Set realistic expectations: High yields often come with higher risks. Avoid chasing high yields exclusively; prioritize long-term value and growth potential.

Seek professional financial advice: A financial advisor can offer personalized guidance tailored to your risk tolerance and investment objectives.

Pros and Cons of Investing in JFIN for Dividends

| Feature | Pros | Cons |

|---|---|---|

| Dividend Yield | Potentially high yield, attractive income stream | High risk of dividend cuts or elimination |

| Growth Potential | Potential long-term growth within the Chinese fintech sector | Volatility inherent in Chinese markets and regulatory uncertainty |

| Financial Health | Subject to thorough analysis; requires careful scrutiny of financials | Debt levels and profitability require careful evaluation. |

| Company Profile | Exposure to the high-growth fintech sector | Operational and regulatory risks in the Chinese fintech landscape |